illinois payroll withholding calculator

The Illinois Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Illinois State Income. The wage base is.

Illinois Paycheck Calculator Tax Year 2022

This is a projection based on information.

. The results are broken up into three sections. The results are broken up into three sections. Instead you fill out Steps 2 3 and 4.

Or keep the same amount. Enter the amount figured in Step 1 above as the total taxable wages on line 1a of the withholding worksheet that you use. Illinois Hourly Paycheck Calculator Results.

Illinois Hourly Paycheck Calculator. This is a projection based on information you provide. Enter your new tax withholding amount.

Free Federal and Illinois Paycheck Withholding Calculator. If you are unable to file electronically you may request Form IL-900-EW Waiver Request through our. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is.

Below are your Illinois salary paycheck results. If the income is paid biweekly multiply the minimum wage times 60 60 x 825 495. 2022 Federal Tax Withholding Calculator 2022 Federal Tax Withholding Calculator.

Just enter the wages tax withholdings and other information required. To change your tax withholding amount. The waiver request must be completed and submitted back to the department.

Paycheck Results is your gross pay and specific. Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4.

Remit Withholding for Child Support to. Use your estimate to change your tax withholding amount on Form W-4. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck.

Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. The waiver request must be completed and submitted back to the department.

Free federal and illinois paycheck withholding calculator. Illinois child support payment information. Tax withheld 0495 x wages line 1 allowances x 2375 line 2 allowances x 1000 number of pay periods.

When the file opens save a copy by accessing Save. This calculator is a tool to estimate how much federal income tax will be withheld. Below are your Illinois salary paycheck results.

Just enter the wages tax withholdings and other information required. Carol Stream IL 60197-5400. The employee should complete the Certificate of Working Outside the State of Illinois form and appropriate withholding form for their state and submit or fax to.

Illinois State Disbursement Unit. 2022 Federal Tax Withholding Calculator. Deducts the child support withholding from the employees wages.

Free federal and illinois paycheck withholding calculator. The Pay Calculator is an Excel spreadsheet that is used to calculate partial month pay and pay adjustments for Academic employees. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line.

Paycheck Calculator Take Home Pay Calculator

Payroll Tax Calculator For Employers Gusto

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Pritzker S Fair Tax Calculator Illinois Review

Illinois Extends Tax Deadline For Storm Affected Counties Including Madison

Solved Illinois Schedule Cr Credit For Taxes Paid To Other Sttes

The Correct Tax Amount For Illinois Ask The Hackrs Forum Leasehackr

Illinois Tax On Moving And Relocation Services Avalara

How To Calculate Illinois Income Tax Withholdings

Tax Withholding For Pensions And Social Security Sensible Money

Illinois Paycheck Calculator Smartasset

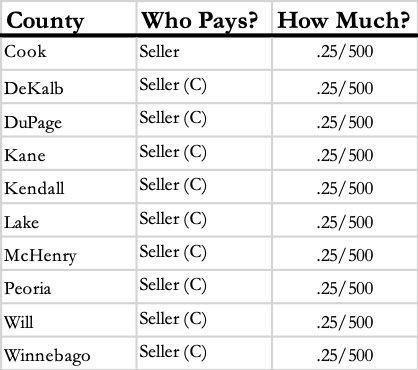

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

Illinois Tax Reform The Dubious Subgroup Schedule Forvis

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay

2 My Paycheck My Future Self Portfolio

Prepare And E File Your 2021 2022 Illinois And Irs Income Tax Return

Illinois Paycheck Calculator 2022 With Income Tax Brackets Investomatica

/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference